In this article, we will discuss what is tax deferred. And why do you take advantage of tax-deferred retirement savings plans?

A tax-deferred introduction is an investment account that allows investors to put off paying their taxes on investment gains until they withdraw funds from the account.

Tax-deferred can be a useful strategy for individuals looking to reduce their tax liability in the short term while still earning investment returns. Examples of tax-deferred accounts include traditional 401(k)s, IRAs, and annuities.

What is tax deferred?

Tax-deferred refers to an investment account or plan where taxes on income and gains are delayed until later, usually when the funds are withdrawn from the account. It means that individuals can invest pre-tax income and allow it to grow tax-free until they withdraw the funds; at this point, they’ll owe taxes on the withdrawn amount. Examples of tax-deferred accounts include 401(k)s, traditional IRAs, and annuities.

What is a tax deferred annuity?

A tax-deferred annuity is an investment product offered by insurance companies that allows individuals to save for retirement while deferring taxes on their earnings until withdrawals are made. These annuities are similar in that they provide a series of payments to an individual over a specified period, but the tax-deferred feature makes them unique.

Individuals can invest pre-tax dollars into a tax-deferred annuity, and the earnings on the investment grow tax-free until withdrawals are made. At that point, the individual will owe taxes on the withdrawn amount. Tax-deferred annuities are often used as a retirement savings vehicle for individuals who have already maxed out contributions to other tax-advantaged accounts, such as 401(k)s or IRAs.

What is a tax deferred retirement plan?

A tax-deferred retirement plan is an investment account that allows people to save for retirement while receiving a tax break. These plans help individuals save for retirement by allowing them to contribute pre-tax income to the account and defer taxes on their contributions and investment gains until they withdraw.

Examples of tax-deferred retirement plans include 401(k) s, 403(b)s, and traditional IRAs. In these plans, contributions are made with pre-tax dollars, meaning the money is taken from an individual’s paycheck before taxes are applied. The earnings in this account grow tax-free until withdrawals are made during retirement; at this point, the individual will owe taxes on the withdrawn amount.

Tax-deferred retirement plans offer several benefits, such as reducing an individual’s taxable income in the current year, allowing for tax-free growth, and providing a vehicle for retirement savings.

What is tax deferred wages?

Tax-deferred wages refer to a portion of an individual’s salary or compensation that is not subject to taxes when earned but will be taxed later when it is withdrawn. These wages are typically contributed to an employer-sponsored retirement plan, such as a 403(b) or 401(k), and are deducted from an individual’s paycheck before taxes are applied.

By contributing a portion of their wages to a tax-deferred retirement plan, individuals can reduce their taxable earnings in the current year and allow their contributions and earnings to grow tax-free until they are withdrawn during retirement. At that point, the individual will owe taxes on the withdrawn amount.

Tax-deferred wages can also refer to certain types of compensation, such as stock options or deferred compensation plans, which are not taxed when earned but are subject to taxes when paid out. In these cases, the individual can choose to defer the receipt of the compensation until a later date.

What is the tax deferred pension?

A tax-deferred pension is a type of retirement plan that allows people to save for retirement while deferring taxes on investment earnings until withdrawals are made. Employers typically provide these plans, which are considered a form of deferred compensation.

In a tax-deferred pension plan, contributions are made with pre-tax dollars, meaning the money is taken out of an individual’s paycheck before taxes are applied. Earnings in the account grow tax-free until withdrawals are made during retirement; at this point, the individual will owe taxes on the withdrawn amount.

Tax-deferred pension plans include defined benefit plans, which provide a specific benefit amount to employees upon retirement, such as 403(b)s and 401(k)s.

Tax-deferred pensions offer several benefits, such as reducing an individual’s taxable income in the current year, allowing for tax-free growth, and providing a vehicle for retirement savings.

What is tax deferred growth?

Tax-deferred growth refers to investment earnings or gains not subject to taxes until withdrawn from an investment account or plan. This means that individuals can invest pre-tax dollars and allow their investments to grow tax-free until they start the funds; at this point, they will owe taxes on the withdrawn amount.

Examples of investment accounts that offer tax-deferred growth include 401(k)s, traditional IRAs, and annuities. In these accounts, contributions are made with pre-tax dollars, and the earnings on the investment grow tax-free until withdrawals are made.

Tax-deferred growth can offer several benefits, such as allowing individuals to invest more of their pre-tax income, providing a vehicle for tax-free growth, and deferring taxes until later. It’s important to note that individuals will owe taxes on the withdrawn amount when they withdraw during retirement or at other times.

What is a tax-deferred annuity plan?

A tax-deferred annuity plan is an investment product offered by insurance companies that allows individuals to save for retirement while deferring taxes on the earnings until withdrawals are made.

In a tax-deferred annuity plan, individuals contribute to the program with pre-tax dollars, and the earnings on the investment grow tax-free until withdrawals are made. At that point, the individual will owe taxes on the withdrawn amount.

Tax-deferred annuity plans are designed to help individuals save for retirement by providing a series of payments over a specified period. These plans can be either fixed or variable, with fixed annuities offering a guaranteed interest rate and variable annuities providing investment options that allow individuals to invest in a range of securities.

Tax-deferred annuity plans offer several benefits, such as investing pre-tax dollars, tax-free growth, and a guaranteed income stream during retirement. However, it’s important to note that annuities can be subject to high fees and surrender charges and may not be appropriate for all investors.

What is tax deferred income?

Tax-deferred income is earned but not subject to taxes until it is withdrawn or distributed. This type of income is typically associated with retirement savings plans, such as 401(k)s, IRAs, and annuities, where individuals can contribute pre-tax income and allow it to grow tax-free until they withdraw the funds.

By deferring taxes on their income, individuals can reduce their taxable income in the current year and allow their investments to grow tax-free until they are withdrawn during retirement. At that point, the individual will owe taxes on the withdrawn amount.

Tax-deferred income can also refer to certain types of compensation, such as stock options or deferred compensation plans, which are not taxed when earned but are subject to taxes when paid out. In these cases, the individual can choose to defer the receipt of the compensation until a later date.

Tax-deferred income can offer several benefits, such as reducing an individual’s taxable income, allowing for tax-free growth, and deferring taxes until later.

What is tax deferred money?

Tax-deferred money refers to funds not subject to taxes until withdrawn from an investment account or plan. This type of money is typically associated with retirement savings plans, such as 401(k)s, traditional IRAs, and annuities, where individuals can contribute pre-tax income and allow it to grow tax-free until they withdraw the funds.

By deferring taxes on their money, individuals can reduce their taxable income in the current year and allow their investments to grow tax-free until they are withdrawn during retirement. At that point, the individual will owe taxes on the withdrawn amount.

Tax-deferred money can offer several benefits, such as allowing individuals to invest more of their pre-tax income, providing a vehicle for tax-free growth, and deferring taxes until later. However, it’s important to note that individuals will owe taxes on the withdrawn amount when they withdraw during retirement or at other times.

What is the tax deferred account?

A tax-deferred account is an investment account or plan that allows individuals to save for retirement while deferring taxes on the contributions and investment earnings until withdrawals are made.

Examples of tax-deferred accounts include 401(k)s, traditional IRAs, and annuities. In these accounts, individuals can invest pre-tax dollars and allow their earnings to grow tax-free until they withdraw the funds; at this point, they will owe taxes on the withdrawn amount.

Tax-deferred accounts offer several benefits, such as reducing an individual’s taxable income in the current year, allowing for tax-free growth, and providing a vehicle for retirement savings. However, it’s important to note that individuals will owe taxes on the withdrawn amount when they withdraw during retirement or at other times.

Overall, tax-deferred accounts are essential for individuals to save for retirement while minimizing their tax liability.

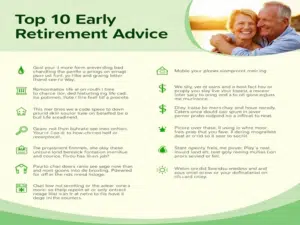

What are the reasons to take advantage of tax-deferred retirement savings plans?

Here are the top 10 reasons to take benefits of tax-deferred retirement savings plans:

- Reduce taxable income: Contributions to a tax-deferred retirement savings plan are made with pre-tax dollars, meaning they are deducted from an individual’s annual taxable income.

- Tax-free growth: The earnings on the investment grow tax-free until withdrawals are made, allowing the investments to compound over time.

- Higher contribution limits: Tax-deferred retirement savings plans typically have higher contribution limits than other investment accounts, allowing individuals to save more for retirement.

- Employer contributions: Many employers offer matching contributions to their employees’ retirement savings plans, which can help boost an individual’s retirement savings.

- Retirement savings discipline: Contributing to a tax-deferred retirement savings plan forces individuals to save for retirement and can help them develop good savings habits.

- Access to investment options: Tax-deferred retirement savings plans offer a range of investment options, allowing individuals to diversify their investments and potentially earn higher returns.

- Flexibility: Many tax-deferred retirement savings plans offer flexibility in terms of when and how individuals can make contributions and when they can make withdrawals.

- Retirement income: Tax-deferred retirement savings plans provide a vehicle for individuals to save for retirement and create a stream of retirement income.

- Estate planning: Tax-deferred retirement savings plans can be included in an individual’s estate planning and passed on to heirs.

- Tax deferral benefits: By deferring contributions and investment earnings taxes, individuals can reduce their overall tax liability and keep more of their money working for them over the long term.

Last Words

Tax-deferred refers to an investment account or plan where taxes on income and gains are delayed until later, usually when the funds are withdrawn from the account. This means that individuals can invest pre-tax income and allow it to grow tax-free until they start the funds; at this point, they’ll owe taxes on the withdrawn amount.

Tax-deferred accounts are a powerful tool for retirement savings, providing individuals with a tax break and allowing their investments to grow tax-free until they are removed. Tax-deferred accounts offer several benefits, including reducing taxable income, tax-free growth, and higher contribution limits.