There often needs to be more clarity between net salary vs gross salary concepts, especially among workers. Generally, during interviews within a recruitment process, we discuss an estimated amount the worker joining the organization will receive. This remuneration that is usually mentioned is the gross salary.

The gross salary is the total before withholdings and Social Security contributions occur. For its part, the net salary is the total the employee receives after these discounts are applied.

Therefore, net salary is what the worker receives, the amount of money that is credited to his bank account or that the employer pays him in hand at the workplace. The company’s gross salary includes the base salary, bonuses, overtime, and supplements. But also the withholdings that must be applied to that total.

An employee receives his work or a service in exchange for a salary. This is the gross salary. He has to pay a contribution, which will be deducted directly from his salary. The amount he gets is the net salary.

Gross Salary Less Contribution = Net Salary.

To be more specific, here’s how the gross salary is calculated:

Gross pay is the number of hours multiplied by the hourly rate. You must add any overtime, bonuses, or commissions freely set by the employer.

Read more: What is a bank statement?

Contributions

Employee contributions are deductions from salaries and make it possible to finance social benefits:

- The bakery

- Retirement

- Supplementary Pension

- Health, Maternity and Death Insurance

- Family Allowance

- Work accident

- Pension insurance

- Training contribution

- Health care coverage

- Housing

- Poverty

Each employee pays these contributions: employee, employee, or manager. Adding them up, they represent about 23 to 25% of salary. The company also pays these same contributions, which is the employer’s share. The employer contribution is payable by all companies, whether industrial, craft, agricultural, or liberal. Employer pays these 2 shares to URSSAF.

This method of calculation is also valid for part-time employees. They will pay the same contribution but in proportion to their working hours.

As you can see, this calculation is quite complicated, as it will depend on the company you are employed with and your status.

Gross salary

Net salary represents gross salary deducted from contributions. Then, you have to deduct income tax again. The actual amount paid to you is called the net pay.

In short, gross salary is before tax, and net salary is available once all charges are deducted.

Public service

The contribution of government employees needs to be more. They represent about 15% of the total payroll (instead of 23 to 25% in the private sector).

For beginners

The salary of an apprentice is different from that of an employee. He is remunerated according to his age and his seniority within the company. He gets a percentage of SMIC.

Young people fewer than 26 and on an apprenticeship contract will not contribute. The gross salary will then be equal to the net salary.

If the apprentice’s gross salary exceeds 79% of the SMIC, contributions are due only for the portion that exceeds this 79%.

For internship contract

Many young people engage in internships and are remunerated not by salary but by internship gratuity. It is also exempt from contributions if it does not exceed the social security exemption. Apart from this, he will make specific contributions.

We also refer to gross pension and net pension for retirees because they also contribute and are subject to the following social security contributions:

CSG (Generalized Social Contribution)

CRDS (Contribution for Repayment of Social Debt)

CASA (Additional Solidarity Contribution for Autonomy)

This represents about 10% depending on your job: worker, employee, or manager.

Gross pension is net pension minus contributions. This is the actual amount you will collect in your bank account.

Net salary vs Gross salary of Executives

When you have executive status, the contribution amount is higher than an employee’s. It is really necessary to add these few ideas:

The percentage deducted for pension is higher

A contribution to APEC (Association for Employment of Executives).

A CET Contribution (Extraordinary and Temporary Contribution)

Thus, the difference between gross and net pay is higher for executives than for other employees with other statuses.

Read more: Fake Bank Statement: How Do You Spot and Prevention It [Best Tips]

What is the Net salary vs Gross salary calculator?

Some payrolls will not have a specific name, but you will notice that it is the total of the accruals section. In other payrolls, it is called “total accrued.” But beware! It is not the money that we will see deposited into our account. From this part, it will be necessary to deduct, on the one hand, the social security contribution and, on the other hand, the Personal Income Tax (IRPF) to obtain the net salary.

Key Difference Between Net Salary vs Gross Salary

Net salary:

The salary is received once the above withholdings and contributions have been carried out. That is, it is the money that we will receive in our payroll account. Therefore, the gross salary will always be greater than the net salary.

Therefore, when you are faced with a job offer, and they tell you that your gross annual salary will be 14,000 euros, do not think you will receive 1,166.66 euros each month. You should know that withholdings will reduce this gross salary. It is vital to consider this to avoid surprises at the end of the month.

Net salary is gross income less income tax deductions, which means the formula for net salary income = gross salary – deduction from income tax source – retirement benefits fits.

Gross salary:

Gross salary is before income tax deduction (fed and state taxes), social security (FICA tax – payroll tax), and gross salary received. At the same time, health insurance is deposited into the employee’s bank account.

Gross salary is paid before any tax or other deductions and includes all bonuses, shift allowances, holiday pay, overtime pay, and other differentials. It excludes taxes deducted at source and retirement benefits (e.g., 401(k) accounts). Benefits (such as group health insurance and other non-cash elements that are part of salary, not counted as part of gross salary);

- The net salary is considered whenever an employee applies for a loan or to verify creditworthiness. However, gross salary is considered in some situations, such as calculating employee bonuses or insurance requirements.

- Also, one can change his net salary or household salary figures, even monthly. Employees can reduce the amount of income tax by following the rules. For example, if one invests in insurance, he will be eligible for exemption under the Income Tax Act and can increase the net salary. More gross salary figures remain the same as determined and determined by the company and mentioned in the employee’s offer letter, but only after the annual rent increases.

- As well as for applying for credit cards, the net salary figure is considered, and based on that, the company decides the credit card limit. One cannot expect a gross salary in their bank AC as taxes or retirement benefits are limited.

FAQs [Net salary vs Gross salary]

What is the difference between net salary vs gross salary?

The gross salary is the amount that the company pays the worker. The net salary is the amount the worker receives each month, discounting the different contributions to Social Security and the withholding of Personal Income Tax (IRPF).

What is the net salary?

The net salary refers to the amount of money a worker receives after deducting all the deductions that correspond to him by obligation. In short, it is the money a person charges for their work and what they receive in their bank account.

What is the gross salary example?

For example, if your monthly salary is $10,000, the range from $8,629.21 to $10,031.07 corresponds to you. Therefore, your gross salary of $10,000 becomes $9,087.84. Additionally, you will have to subtract the amount corresponding to the IMSS.

How do I get the monthly net salary?

Calculating your monthly net salary is simple. It is enough to know the salary and personal data of the worker, apply the taxes that must be deducted from the gross annual salary, subtract them from the gross annual salary, and then divide that final amount by 12 or 14, depending on the number of payments.

How is payroll calculated?

It is obtained by dividing the monthly salary by 30. For example, a fashion designer has a monthly salary of $17,000.00. To obtain her daily salary, we divide 17,000 by 30, resulting in 566.66 pesos.

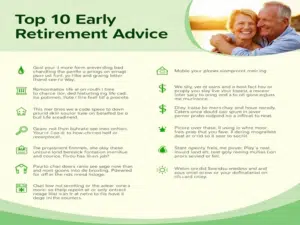

Conclusion

So, whenever an employee receives an offer letter from the company, they should consider all the factors mentioned above because they ignore this figure of retirement benefits, and if they become a major part of their CTC, what they expect to be their net salary or household salary. Do less comes.

For example, Mr. X received an offer from ABC Company, which mentioned in the offer letter that they would pay Rs.9,00,000/- as CTC, which includes Rs. The employee should then consider being paid hand-to-hand by dividing the 401(k) contribution (9,00,000 less Medicare 90,000)/12 and 9,00,000/12 without withholding federal tax.